|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Refinance Offers: A Comprehensive GuideHome refinance offers can be a beneficial financial tool for homeowners looking to adjust their mortgage terms. Whether your goal is to secure a lower interest rate, reduce monthly payments, or tap into home equity, refinancing could be the right option. What is Home Refinancing?Home refinancing involves replacing your existing mortgage with a new loan, often with better terms. This process can lead to significant savings and increased financial flexibility. Benefits of Refinancing

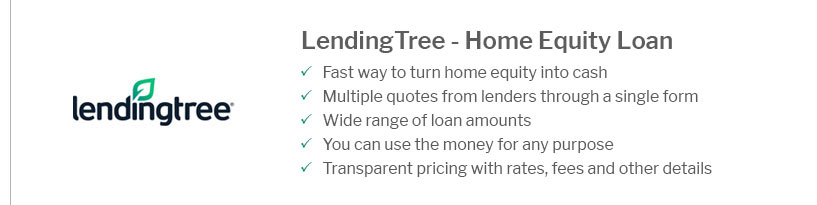

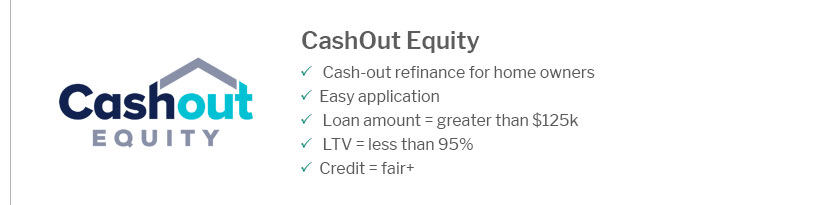

Types of Refinance OffersThere are various types of refinance offers available, each catering to different financial goals and situations. Rate-and-Term RefinanceThis type of refinancing focuses on changing the interest rate, loan term, or both without altering the loan balance. It’s ideal for homeowners looking to reduce interest expenses or shorten their mortgage period. Cash-Out RefinanceWith a cash-out refinance, you borrow more than your existing mortgage balance and pocket the difference, which can be used for home improvements or other expenses. To calculate potential returns, use a refinance rental property calculator. Steps to Consider Before Refinancing

FAQWhat are the common costs associated with refinancing?Refinancing typically involves costs such as application fees, appraisal fees, and closing costs. These can vary depending on the lender and the specifics of the loan. How do I know if refinancing is right for me?Consider your financial goals, current mortgage terms, and potential savings. Consulting with a financial advisor can also help you make an informed decision. Can I refinance with bad credit?It is possible to refinance with bad credit, but options may be limited and could result in higher interest rates. Improving your credit score before refinancing can lead to better offers. https://www.uwcu.org/mortgage-home-loans/refinance/offers/

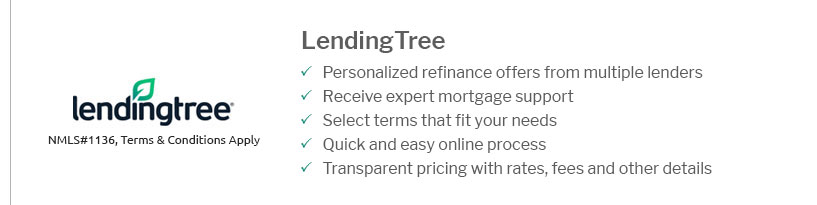

Maximize your savings by combining these great offers when refinancing your existing home loan. Closing Cost Discount: Up to $500 off closing costs. https://www.lendingtree.com/home/mortgage/refinance-offers-study/

Nationwide, the share of 30-year, fixed-rate mortgage refinances offered to users of the LendingTree marketplace jumped by 41.59% from September ... https://www.discover.com/home-loans/rates/refinance-rates/

See current mortgage refinance rates from Discover Home Loans. Low fixed rate loans come with $0 application fees, $0 origination fees, $0 appraisal fees, ...

|

|---|